GET A LOAN

When it comes to Pawn Shops, getting a loan is the name of the game. Here’s how pawn shop loans work: You bring in an item as collateral. The pawnbroker will determine the item’s value, give you a loan based on its cost, and then hang on to your collateral until you’ve paid the loan with interest.

STEPS AND REQUIREMENTS FOR A PAWN SHOP LOAN

One of the main benefits of a pawn shop loan is how easy they are to get. In most cases, all you need is a valuable item and a government ID.

Some of the most common collateral includes jewelry, electronics, power tools, coins, firearms, and even vehicles.

We do require you to show a valid government ID, such as a driver’s license, to verify you are legally allowed to take out the loan.

Once we appraise your item, we’ll let you know the dollar amount we can advance. Negotiations may occur, but once we agree to a price, you walk out with cash while we hold your item.

The time period on the loan does vary depending on state laws. When your item is in our possession, rest assured that we keep it safe and secure.

When you repay your loan, you can reclaim your item. In most cases, if you need more time, we can offer an extension or renewal as permitted by law. Not paying off your loan is entirely acceptable, especially since it does not affect your credit score. The only problem is that you forfeit the item being pawned.

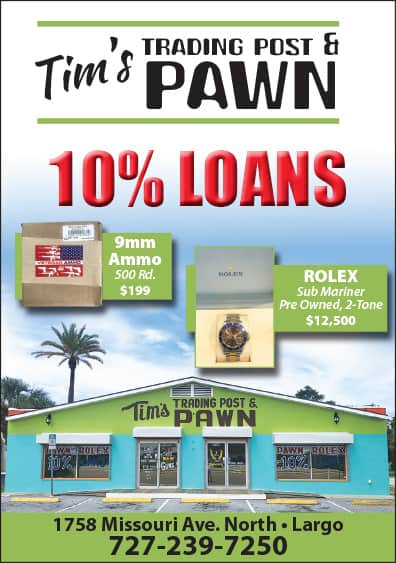

THE TIM’S TRADING POST AND PAWN DIFFERENCE

Tim’s Trading Post and Pawn is home to the 10% loan. *The national average for pawn shop loans are between 20-25% monthly plus additional fees.

Tim’s Trading Post and Pawn is regulated and reputable. We have the most competitive pawn shop loan program around.

Our staff is polite and professional and works hard to offer you the highest dollar amount possible on any items you have of value. Again, we are home to the 10%.

Have Questions?

Click Here

Read Common FAQ’s

Click Here